Outside the ElevAIting Eleven — Adobe’s Underrated Strength

The case for Adobe as a quality investment beyond AI mania

Introduction

Recently we introduced the ElevAIting Eleven and pointed to the rather extreme valuations these companies suffer from, distorting the stock market and creating an investment bubble whose burst seems imminent (we’ve just seen another potential catalyst: the Bank of Japan increasing the interest rate to 0.75% with a signal of an upward trend – a move that may soon generate outsized demand for soothing yoga sessions among distressed hedge fund managers).

We also briefly analyzed valuations of prominent members of the ElevAIting Eleven and explained that we’re not going to jump onto this peculiar ElevAItor – it would be like trying to leap onto a train running at full speed toward an abyss.

We did mention, however, that severe overvaluation in one part of the capital market likely leads to clear undervaluation in another – creating the opportunity to buy great businesses at very attractive prices.

This is especially important because, as investors, we’re looking not only for quality but also for a margin of safety, which is essential to minimize risk and increase long‑term returns. Risk management is an often overlooked aspect of investing – hopefully we can cover it on another occasion, as it goes beyond the scope of this article.

Adobe Systems

So now it’s time to look at the very first counterexample of AI‑mania stocks: Adobe Systems – a high‑quality company with a real business and real cash flows, deeply embedded in workflows and a golden standard for creative professionals: designers, illustrators, photographers, video editors, and digital artists.

Without doubt, Adobe generated a lot for its shareholders in the past. Since recently (after publishing its Q4 results on Dec 10) it became quite a hot stock, we’ll offer some more comments about it.

Adobe has also been caught in the crossfire of the recent AI‑mania, with skeptics questioning whether the company can defend its position as a wave of AI‑native competitors emerges. The concern is that generative tools will replicate key functions of Adobe’s creative suite, put pressure on pricing, and gradually weaken its long‑standing moat in design and content creation.

At the same time, this narrative often overlooks Adobe’s advantages: its massive installed base, deep integration into professional workflows, and the fact that it is embedding AI directly into its own products (e.g., Firefly) rather than waiting to be disrupted from the outside.

Of course, a swarm of potential competitors sprouting up like weeds might worry investors, but what many overlook is that most of these newcomers are likely just that: weeds. It’s not a quickly built piece of software that makes a great business. A great business is built on things like a strong organizational culture, deep integration with customers’ workflows, years of product refinement, and a reputation as the gold standard in its category.

Adobe has all of that: it is the default choice for creative professionals, it’s tightly embedded in countless corporate processes, and its ecosystem of tools, file formats, plugins, and training materials creates real switching costs.

We do not have a crystal ball and of course there’s a chance we’re underestimating some competitors. Still, we simply think it’s not that easy to compete with Adobe – just as it isn’t easy to beat Coca‑Cola, even though almost any company can produce a carbonated sugar drink. For Coke’s advantage doesn’t lie only in the recipe; it lies in brand, distribution, and decades of entrenchment supercharged by an almost unbelievable in its effectiveness, highly structured global propaganda. Adobe’s edge is similarly rooted in much more than just its current set of apps.

A look at numbers

When we looked at Adobe during those rainy autumn evenings, we had a (rather rare) feeling of absurdity: the more money Adobe generates, the cheaper the stock seems to get.

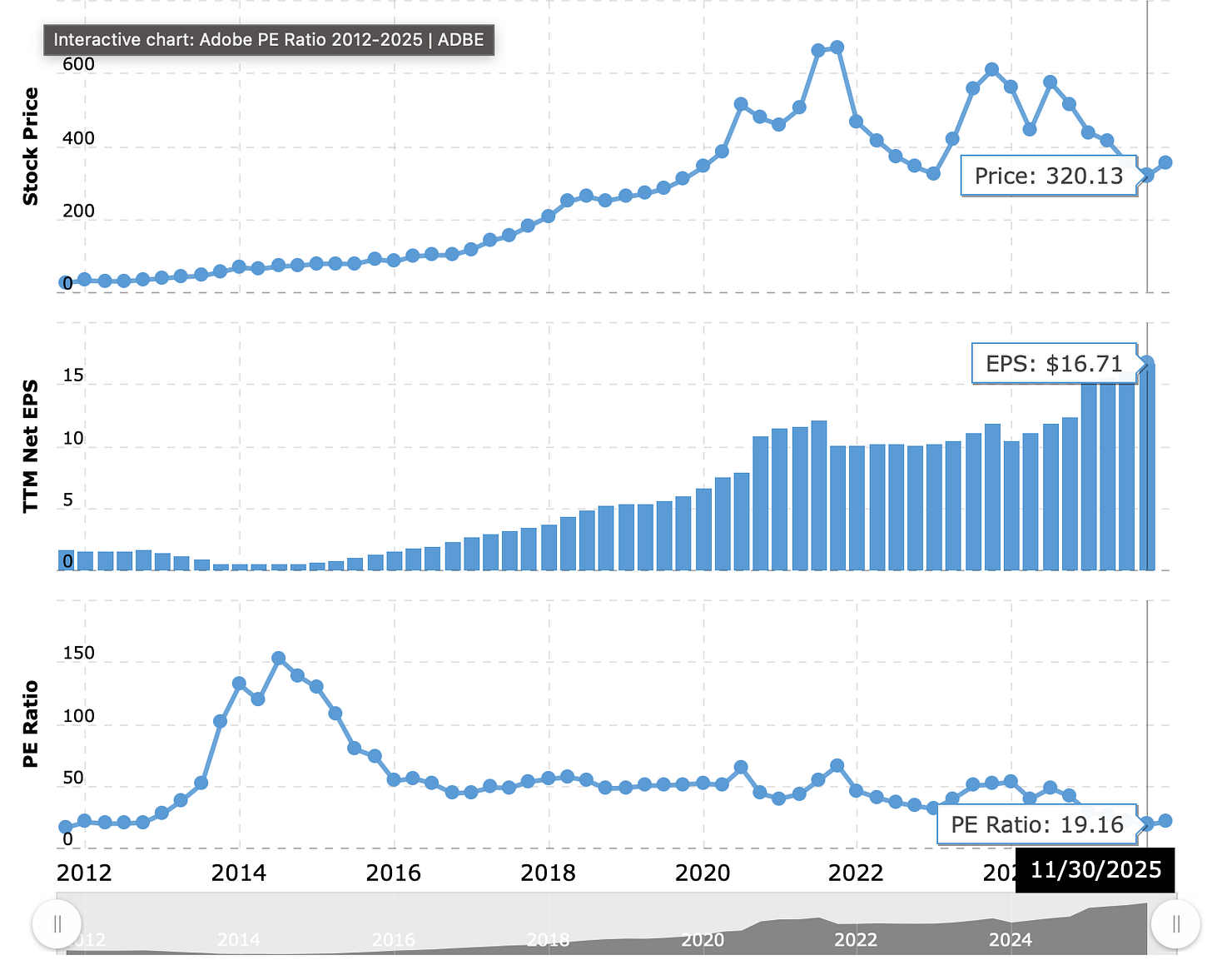

Let’s take a look at Adobe’s price history, along with its TTM Net EPS (Trailing Twelve Months Net Earnings Per Share) and the resulting P/E ratio:

Note: All valuation metrics below use data available at the end of November 2025, before most financial portals incorporated Adobe’s newly reported Q4 and full‑year FY2025 results (fiscal year ending November 28, 2025).

Just think about it: two years ago, Adobe was trading at around $611 per share, with TTM Net EPS of $11.81.

Fast forward to now: at the end of November 2025, Adobe was down to $320.13 – nearly half of what people were willing to pay in November 2023:

Did something go wrong within these two years? Did the company lose its earnings, perhaps?

Oh no. It actually makes more than back then: $16.71. That means Adobe now generates about 41.5% more profit, while the stock is almost 48% cheaper. Such abnormal fluctuations seem to happen only on capital markets, with P/E going from ~52x to ~19x.

Disclaimer: we observed Adobe for quite a long time and were quite lucky to buy it in last week of November which happened to be near a bottom, with the price averaging ~$318 per share. Of course, we did not know where the bottom is - but we knew we’re buying very cheap.

We expected Adobe to perform well (and actually many analysts did, at Yahoo Finance Forward P/E was only 13.7x for 11/30/2025) but the results of Q4 published on December, 10 went above the expectations. To quote directly from the report: “Adobe achieved record revenue of $6.19 billion in its fourth quarter of FY2025, which represents 10% year-over-year growth as reported and in constant currency. Diluted earnings per share was $4.45 on a GAAP basis and $5.50 on a non-GAAP basis.” (Note by CyberMoat: EPS is for the quarter).

Buybacks as smart capital allocation

We also liked Adobe’s management aggressive buyback program. In 2023 the company repurchased approximately 11.5 million shares, in 2024 around 17.5 million shares, and then in 2025 – when the stock was by far the cheapest relative to its recent history – a massive 30.8 million shares. We consider this a great example of capital allocation: management leaning in when the odds are finally skewed in shareholders’ favor.

For balance, one could also argue that this pattern is indirect evidence that earlier repurchases were done at too high a price, potentially destroying value. Of course, we don’t know how management perceived Adobe’s intrinsic value back then versus now, but we have our own estimate – and on that basis we are much more comfortable with the aggressiveness of the 2025 buyback than with the timing of the earlier ones.

Since buybacks, especially aggressive ones, may distort other measures like earnings-per-share (less shares in circulation → automatically more profit per share), one should also ensure that we get the picture right. After all, earnings can be “engineered” via various accounting tricks or get impacted by exactly the kind of buybacks we just mentioned.

To avoid such distortions, let’s switch to another metric, Free Cash Flow (FCF), that shows how much cash the actual operations produce – since we always remember that, after all, cash is king.

And there is good news here: Adobe was, and remains, a cash‑making machine with impressive FCF growth, a strong proof that we’re looking at what we truly could call a great business.

Just look at the FCF chart – it’s a textbook example of quality investors’ preference for businesses that consistently compound free cash flow per share over long periods.

Note: The chart above is sourced from finbox.com and shows FCF per share, which finbox defines as levered free cash flow on a per common share basis. Since terms like “free cash flow” can vary across sources and Adobe itself emphasizes operating cash flows, we use these figures primarily to illustrate the general trend in cash generation rather than as a strict, universally standardized metric.

Overall View

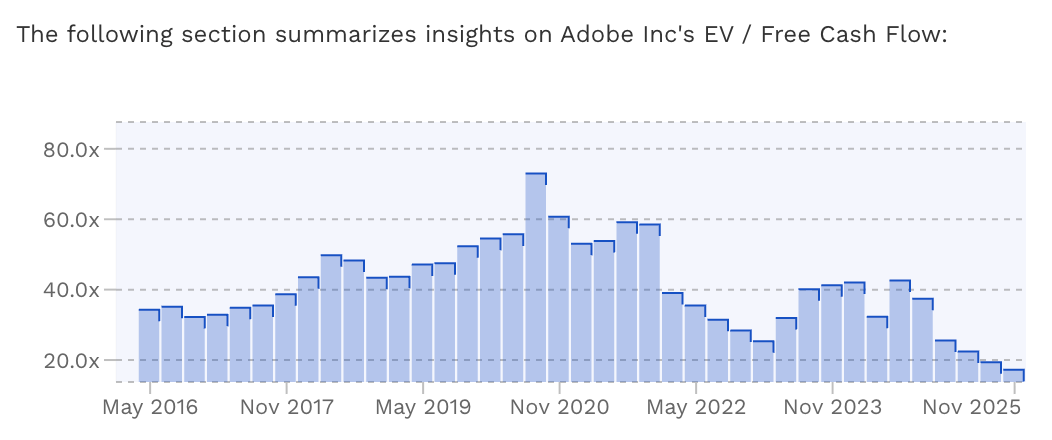

And for completeness, looking at Adobe’s Enterprise Value / Free Cash Flow, we can see that in November 2025 it was trading at historical lows (Adobe’s EV/FCF hit 13.6x at 28 Nov), underscoring how cheaply the market was pricing each dollar of the company’s free cash generation relative to prior years:

This confirms our view that Adobe is making more money than ever while having recently traded at valuation lows.

The strong results published just a couple of days ago, and the subsequent price spike (Adobe closed at $355.86 on Dec 19), are perhaps the first clear signal of how undervalued the company was. At CyberMoat, we don’t pretend to predict the future, but we believe Adobe still has meaningful upside relative to our estimate of fair value.

This is one example of what we see as a clear undervalued opportunity outside the generally overpriced ElevAIting Eleven. We’ll highlight a few other such ideas (including some we’ve already hinted at) another time—stay tuned.

- Michał, CyberMoat

Uncovering risks, securing opportunities.